As a business owner, you are constantly faced with challenges and risks that can impact the success of your company. One of these risks is the possibility of unforeseen events such as natural disasters, accidents, or lawsuits that can cause significant financial loss for your business. This is where commercial insurance comes into play, providing protection for your business against these risks. In this article, we will delve into the importance of commercial insurance for your business and how it can safeguard your company’s assets and ensure its continuity.

What is Commercial Insurance?

Commercial insurance, also known as business insurance, is a type of coverage designed to protect businesses from potential financial losses due to unexpected events. This insurance provides coverage for property damage, liability, and employee-related risks, among others. It is essential for all types of businesses, whether large or small, to have some form of commercial insurance to safeguard their assets and interests.

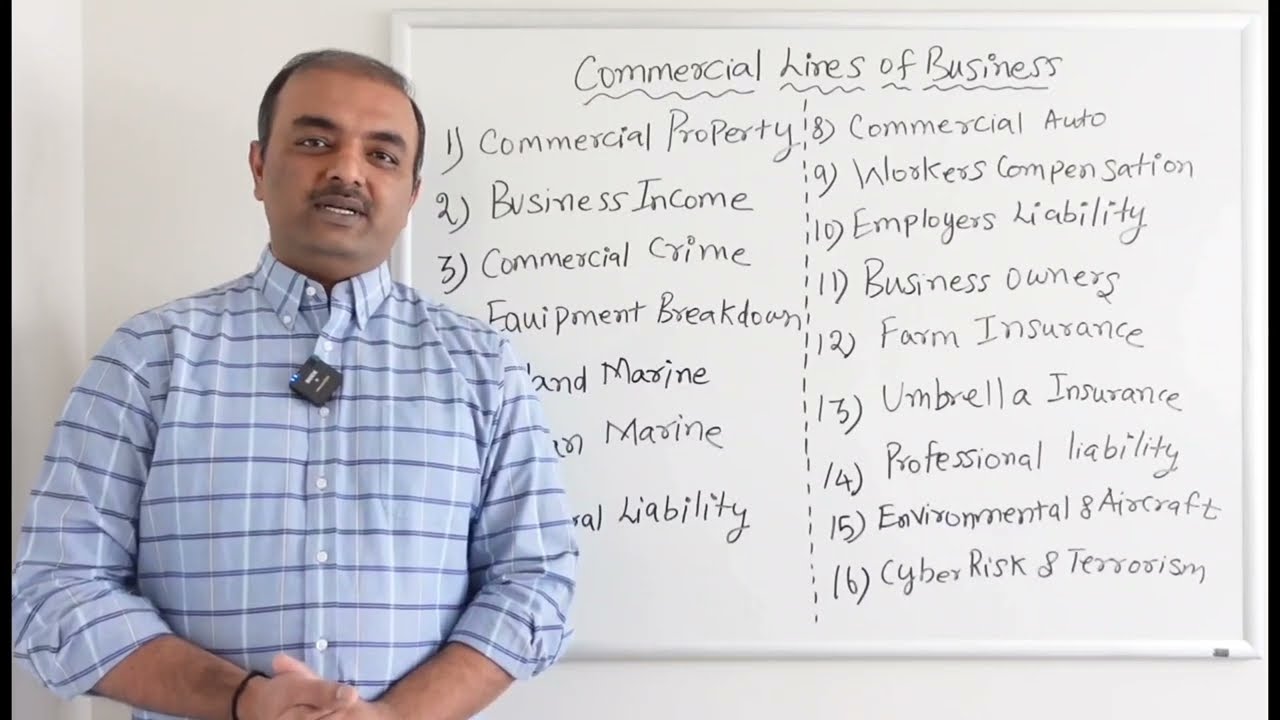

Types of Commercial Insurance

Commercial insurance encompasses various types of coverage, each serving a different purpose for businesses. Some of the most common types of commercial insurance include:

- General Liability Insurance: General liability insurance protects businesses against claims of bodily injury or property damage caused by their products, services, or operations. This type of coverage also includes legal fees in case of a lawsuit.

- Property Insurance: Property insurance offers protection for physical assets such as buildings, equipment, and inventory against damage or loss caused by natural disasters, theft, or vandalism.

- Workers’ Compensation Insurance: Workers’ compensation insurance provides coverage for employees who get injured or become ill while on the job. It covers medical expenses, lost wages, and any legal fees associated with the claim.

- Professional Liability Insurance: Professional liability insurance, also known as errors and omissions insurance, provides protection for businesses against claims of negligence, errors, or omissions in their professional services.

- Cyber Liability Insurance: In today’s digital world, cyber liability insurance is becoming increasingly important for businesses. This type of coverage protects against losses resulting from cyber attacks, data breaches, and other cyber threats.

Why is Commercial Insurance Important for Your Business?

Now that we have a basic understanding of what commercial insurance is let’s dig deeper into why it is crucial for your business.

Protects Your Business Assets

One of the main reasons to have commercial insurance is to protect your business assets. Your business is likely to have valuable physical assets, such as equipment, inventory, and property, that are essential for its operations. In case of any damage or loss, commercial insurance will cover the cost of repairing or replacing these assets, ensuring that your business can continue to function without incurring significant financial loss.

Moreover, commercial insurance also provides protection for intangible assets such as intellectual property, trade secrets, and customer data. These assets are equally important for the success of your business and need to be safeguarded through appropriate insurance coverage.

Ensures Continuity of Your Business

Unexpected events such as natural disasters, accidents, or lawsuits can cause significant financial losses for businesses. Without proper insurance coverage, these losses can be devastating and potentially lead to the closure of your business. However, with commercial insurance, you can have peace of mind knowing that your business is protected, and in case of any unforeseen circumstances, it can continue to operate without facing financial ruin.

Complies with Legal Requirements

Depending on the type of business and its location, there may be legal requirements for commercial insurance. For example, most states require businesses to have workers’ compensation insurance to provide coverage for their employees. Failing to comply with these legal requirements can result in penalties, fines, and even the suspension of your business operations. Therefore, having commercial insurance not only protects your business but also ensures that you are compliant with the law.

Attracts and Retains Employees

In today’s competitive job market, offering employee benefits such as health insurance and workers’ compensation can be a significant factor in attracting and retaining top talent. Commercial insurance provides coverage for these benefits, making your business more attractive to potential employees. It also shows that you are invested in the well-being and safety of your employees, which can improve their job satisfaction and loyalty towards your company.

How to Use Commercial Insurance for Your Business

Now that we have discussed the importance of commercial insurance let’s see how you can effectively use it for your business.

Assess Your Risks

The first step in using commercial insurance is to assess your business risks. Every business is unique, and therefore, its insurance needs will also vary. Identify the potential risks that could impact your business and determine which types of insurance coverage would best protect against those risks.

Choose the Right Coverage

Once you have identified your risks, it’s essential to select the appropriate coverage for your business. You can consult with an insurance agent or broker who specializes in commercial insurance to help you understand the different types of coverage and which ones are best suited for your business.

Review and Update Regularly

As your business grows and changes, so do your insurance needs. It’s crucial to review your insurance policies regularly and update them accordingly. For example, if you expand your business operations or add new services, you may need to adjust your coverage to ensure adequate protection.

Examples of How Commercial Insurance Can Protect Your Business

To better understand how commercial insurance can safeguard your business, here are some examples:

- A fire breaks out at your business’s warehouse, destroying your inventory and causing severe damage to the property. With property insurance, you can file a claim and get reimbursed for the cost of repairing or replacing the damaged assets, ensuring that your business can continue to operate.

- An employee at your restaurant slips and falls, injuring their back. With workers’ compensation insurance, you can cover their medical expenses and lost wages while they recover.

- A client sues your consulting firm, claiming that your advice led to financial losses for their business. Professional liability insurance will cover the legal fees in defending against the lawsuit and any potential settlement or judgment costs.

Comparisons: Commercial Insurance vs. Personal Insurance

You may be wondering why your business needs a separate insurance policy when you already have personal insurance. Here are some key differences between commercial and personal insurance:

- Coverage: Personal insurance policies are designed to protect individuals and their families, whereas commercial insurance provides coverage for businesses and their assets.

- Liability: Personal insurance covers liability arising from personal activities, such as car accidents or injuries on your property. On the other hand, commercial insurance covers liability related to business operations, products, or services.

- Cost: Commercial insurance tends to be more expensive than personal insurance due to the higher level of risk associated with running a business.

- Legal Requirements: As mentioned earlier, some forms of commercial insurance are mandatory by law, whereas personal insurance is not.

Advice for Choosing the Right Commercial Insurance

Choosing the right commercial insurance can be overwhelming, but here are some tips to help you make an informed decision:

- Assess Your Risks: As mentioned earlier, understanding your business risks is crucial in selecting the appropriate coverage. Do a thorough assessment and consider consulting with an insurance professional to identify any potential blind spots.

- Research: Do your research and compare different insurance providers to find the best coverage and rates for your business. Don’t just settle for the first option you come across.

- Read the Fine Print: Before signing on the dotted line, make sure to read the policy thoroughly and understand the coverage, limits, and exclusions.

- Bundle Policies: Many insurance companies offer discounts for bundling multiple types of coverage, so consider bundling your commercial insurance policies to save on costs.

- Review Annually: As mentioned earlier, regularly review and update your insurance policies to ensure that your business is adequately protected.

FAQs about Commercial Insurance

Q: Do I need commercial insurance even if I have a small business?

A: Yes, all businesses, regardless of their size, need some form of commercial insurance to protect against potential risks and losses.

Q: Can I cancel my commercial insurance at any time?

A: Some insurance companies may have cancellation fees or require you to complete the contract term before terminating the policy. Always check with your insurance provider for their specific guidelines.

Q: What happens if I don’t have commercial insurance?

A: Without commercial insurance, your business is at risk of facing significant financial losses in case of unexpected events. It may also result in legal penalties if you fail to comply with legal requirements for insurance.

Q: Do I need different types of commercial insurance for each of my business locations?

A: It depends on the type of coverage you have and the insurance company’s guidelines. Some policies may cover multiple locations, while others may require separate policies for each location. Always consult with your insurance provider for clarification.

Q: What should I do if I need to file a claim?

A: In case of an unforeseen event, contact your insurance provider immediately to report the incident and initiate the claims process. Make sure to document everything related to the loss, including photos, receipts, and any other relevant information.

Conclusion

In conclusion, understanding the importance of commercial insurance for your business is crucial in protecting your assets, ensuring continuity, and complying with legal requirements. By assessing your risks, choosing the right coverage, and regularly reviewing your policies, you can effectively use commercial insurance to safeguard your business and its future success. Remember, every business has unique needs, so consult with an insurance professional to find the best coverage for your specific business. Don’t wait until it’s too late, invest in commercial insurance today and protect your business from potential risks and losses.